If you only do one thing this week, do this.

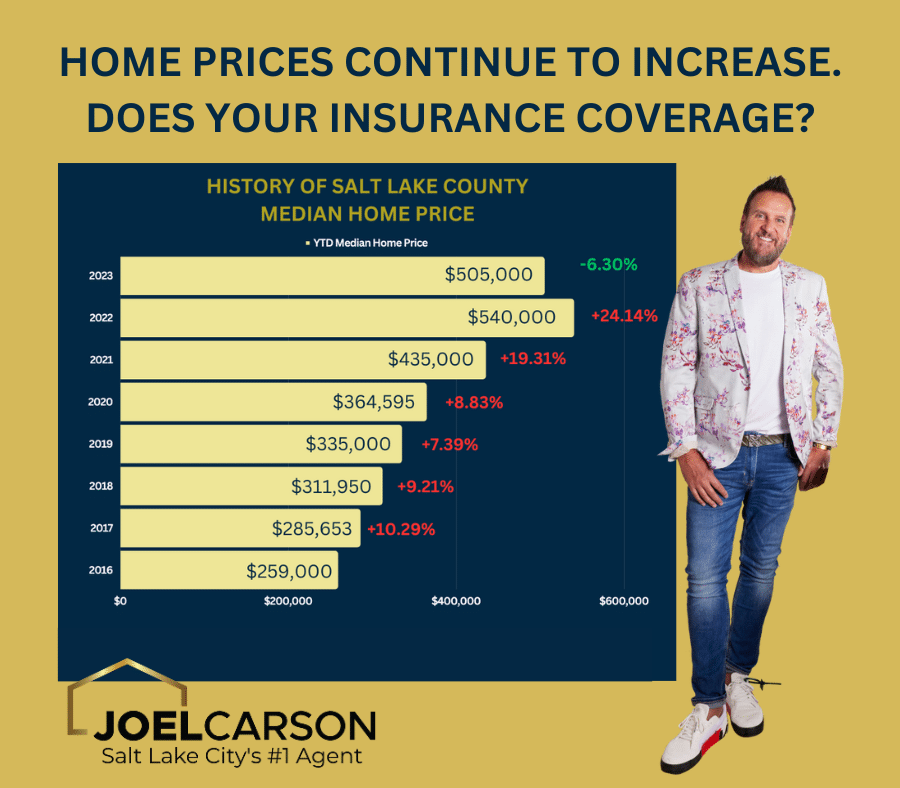

The real estate market is traditionally as predictable as a wild raft ride down a twisted river. You just never know what’s coming around the next corner. One thing we do know? The median home price in Salt Lake County has increased 94.98 percent since 2016. If you purchased your home just seven years ago, its value could very well have doubled.

“The cost to build a home now is through the roof. “

~ Allen Johnson

Allen Jonson Insurance Agency

powered by American Family Insurance

It must feel good to have all that equity. Have you taken the time to insure it? Sandy American Family Insurance Specialist Allen Johnson said it’s crucial for homeowners to review their insurance annually.

It’s not just that your home is worth more today than it was two years ago, “The cost to build a home now is through the roof,” Allen said. If your insurance agent isn’t reaching out to you personally every year, that agent is not providing you with important information you need to make an informed decision about coverage.

“We do a full insurance review for every one of my clients every year when their insurance renews,” he said. “It is up to the insurance agent to call the customer.” If it’s been more than a year since you discussed coverage with your agent, it might be time to get a new one..

If you only do one thing this week, do this. Do not wait for a disaster to find out you’re underinsured.

Would you be able to replace your home with the insurance you have now?

Salt Lake County home prices have increased 94.98 percent since 2016. Did you increase your home insurance coverage accordingly? Take time to speak to your insurance representative to make sure you can replace your existing home.

How much coverage do you need?

Well, it depends. There are so many variables that should impact the amount and type of insurance you need. Focus on replacement cost. “I don’t insure clients for less than $250 per square foot,” Allen said. “The cost to build a home now is through the roof.” Five years ago the average coverage would be $115 to $160 per square foot. As one of Utah’s top insurance agents, he said he has seen the cost of plumbing and electrical components quadruple.

If your home is insured for a replacement cost cap of $115 per square foot, you’re going to come up short when it’s time to rebuild in the event of a disaster.

The types and amounts of coverage required (and the cost of that coverage) vary. Several factors can influence the amount of insurance coverage needed for a home. These include:

- Replacement Cost: The cost to rebuild or repair the home in case of damage or destruction, including labor and materials.

- Home Value: The market value of the home, which may differ from the replacement cost due to factors like location and market conditions.

- Dwelling Size: The square footage of the home, as larger homes generally require more coverage.

- Construction Materials: The type of materials used in the construction of the home, as some materials may be more expensive to replace or repair than others.

- Additional Structures: Coverage for detached structures like garages, sheds, or fences, which may require additional insurance.

- Personal Belongings: The value of personal possessions inside the home, including furniture, appliances, electronics, clothing, and other items. This may require separate coverage or endorsements for valuable items.

- Location: Factors such as the neighborhood, proximity to natural disaster-prone areas, crime rates, and fire protection services can impact insurance costs.

- Special Features: Unique features like swimming pools, hot tubs, or high-end upgrades may require additional coverage.

- Liability Protection: The amount of liability coverage needed to protect against lawsuits or claims if someone is injured on the property.

- Deductible: The amount the homeowner is willing to pay out of pocket before the insurance coverage kicks in. Higher deductibles may lower the premium but require a greater financial commitment in the event of a claim.

Consult with an insurance agent to assess these factors and determine the appropriate amount of insurance coverage needed for your specific home given current market conditions. While you’re at it, take time to look at the big picture.

Look at the big insurance picture yearly

Let’s face it, things change. Local, state, and national economies change. Costs go up. Babies are born, children leave the nest, and people buy and sell homes, cars, boats, campers, etc. The most effective way to manage your insurance portfolio is with the help of one insurance maestro to orchestrate coverage.

Commit this term to memory: 360 Insurance Review.

A 360 insurance review helps you figure out what insurance you need for different things in your life. It looks at everything, like your health, car, home, and more. By using a special calculator, it checks your info and gives suggestions on the right amount of coverage you should have. It’s like a checkup for your insurance to make sure you’re protected should something go awry.

Following is a list of just 10 types of insurance coverage you might need to consider:

- Auto Insurance: Coverage for vehicles against accidents, theft, and damage.

- Health Insurance: Provides medical coverage for healthcare expenses, including doctor visits, hospital stays, and prescription medications.

- Life Insurance: Offers financial protection to beneficiaries in the event of the insured person’s death.

- Homeowners Insurance: Protects homes and belongings against damage, theft, and liability.

- Renters Insurance: Covers the belongings of renters and provides liability protection for incidents within a rented property.

- Disability Insurance: Provides income replacement if you become disabled and are unable to work.

- Travel Insurance: Offers coverage for unexpected events or emergencies that may occur during domestic or international travel.

- Business Insurance: Protects businesses from various risks, including property damage, liability claims, and business interruption.

- Pet Insurance: Covers veterinary expenses for pets, including medical treatments, surgeries, and medications.

- Umbrella Insurance: Provides additional liability coverage that goes beyond the limits of other insurance policies, offering broader protection.

These are just a few examples. Each type of insurance serves a different purpose and provides coverage for specific risks or needs. It’s important to evaluate your individual circumstances and consult with insurance professionals to determine the types of insurance that are most relevant and necessary for your situation.

What kind of homeowner’s insurance do you need?

The type of homeowner’s insurance you need depends on your property, your goals, and your purpose for buying insurance.

Here is a list of common types of homeowners insurance:

- Dwelling coverage: Protects the structure of your home against covered perils, such as fire, windstorm, or vandalism

- Personal property coverage: Covers the belongings inside your home, such as furniture, appliances, electronics, and clothing, against theft, damage, or loss

- Liability coverage: Provides financial protection if someone is injured on your property and files a lawsuit against you

- Additional living expenses coverage: Covers the costs of temporary living arrangements if your home becomes uninhabitable due to a covered event, such as a fire or severe damage

- Medical payments coverage: Pays for medical expenses if someone is injured on your property, regardless of fault

- Other structures coverage: Insures detached structures on your property, such as garages, sheds, or fences

- Loss of use coverage: Covers additional living expenses when you cannot reside in your home due to a covered loss

- Scheduled personal property coverage: Offers additional coverage for high-value items like jewelry, art, or collectibles that may exceed the limits of standard personal property coverage

- Flood Insurance: Provides coverage for damage caused by floods, which is not typically covered by standard homeowners insurance. It is a separate policy obtained through the National Flood Insurance Program (NFIP) or private insurers

- Earthquake Insurance: Offers coverage for damage resulting from earthquakes, which is usually excluded from standard homeowners policies (it is a separate policy that can be obtained in areas prone to seismic activity)

Remember, the specific coverage options and terms may vary between insurance companies and policies. It’s important to review and understand the details of your homeowner’s insurance policy to ensure it meets your specific needs and offers adequate protection. If you have a mortgage on the insured property, your lender might have some specific requirements too.

Now is the time to consider your coverage

I meet and conduct business with so many people as a real estate agent. I love it. One thing I don’t love is finding out one of my client’s home insurance is inadequate when disaster strikes.

As I said before, It’s important for your insurance specialist to reach out and talk to you every year to review your options. Allen said if they fail to do so, it could lead to legal problems later on if you need repairs or replacements. So, it’s a good idea to stay in touch with your specialist to ensure your coverage is up to date.

All homeowners insurance is not created equal

The best way to make sure you have the right coverage (and understand it) is to become familiar with insurance terms that your specialist might use.

Not all homeowners insurance policies automatically provide replacement cost coverage. Homeowners’ insurance policies can offer different types of coverage, including replacement cost coverage and actual cash value (ACV) coverage.

Replacement cost coverage pays for the cost of replacing damaged or destroyed property with a new one of similar kind and quality, without factoring in depreciation. This means that the insurance company would provide funds to replace your belongings or repair your home with new items or materials.

On the other hand, actual cash value (ACV) coverage takes depreciation into account when determining the value of the damaged property. In the event of a claim, the insurance company would consider the age and condition of the item and provide coverage based on its current value, which may be lower than the original purchase price.

If you want replacement cost coverage for your home and belongings, you may need to request or add it to your policy. When you talk to your homeowner’s insurance agent this year (and you are going to do that, aren’t you?). Make it a point to ask about replacement cost versus actual cash value.

Still have questions about homeowner’s insurance? Call me, Joel Carson, at 801-673-3333.