Are you ready to buy your new home? Most first-time homebuyers wonder, “How much are closing costs in Utah?” That’s a great question, Truth in Lending requires your lender to give you a detailed answer.

The Truth in Lending Act (TILA) is a federal law in the United States designed to protect consumers by promoting the informed use of credit through clear disclosure of terms and costs. Enacted in 1968 and amended several times, it says lenders must provide borrowers with clear and accurate information about the costs and terms of credit including the following:

- annual percentage rate (APR)

- finance charges

- total amount financed

- payment schedule

TILA applies to most types of consumer credit, including loans, credit cards, and mortgages, ensuring that consumers can compare offers from different lenders and understand the true cost of borrowing. TILA gives consumers the right to cancel certain credit transactions within a specified period. Violations of TILA can result in legal penalties, including damages and rescission of the loan. Overall, TILA empowers consumers to make informed financial decisions and protects them from unfair or deceptive lending practices.

As you prepare to buy your new Utah home, factor the expense of closing costs into your budget. How much are closing costs in Utah? I can’t determine how much yours will be. There’s so much to take into consideration. Understanding the factors used to determine what you should bring to the table at closing will make the process much easier.

Why is ‘Truth In Lending’ Important?

The Truth in Lending Act (TILA) is a federal law that protects consumers in credit transactions. Passed in 1968 and now part of the larger Consumer Credit Protection Act, TILA aims to promote transparency and fairness in lending practices. The law requires lenders to disclose key information about credit terms, costs, and conditions, ensuring borrowers have clear and understandable details before entering into credit agreements. TILA mandates the provision of a standardized Loan Estimate and Closing Disclosure, helping borrowers compare loan offers accurately. TILA helps foster responsible borrowing and informed financial decisions by empowering consumers with knowledge. .

Consumer protection

TILA was designed to safeguard consumers from misleading, deceptive, and fraudulent lending practices. The law aims to ensure borrowers have access to clear, accurate, and standardized information about credit terms, costs, and conditions.

Transparency

TILA requires lenders to disclose all essential information related to credit agreements, enabling borrowers to make informed decisions and compare loan offers from different lenders.

Fair lending practices

TILA promotes fair lending practices by preventing lenders from engaging in discriminatory or exploitative tactics that could disproportionately affect certain groups of borrowers.

Empowering borrowers

By providing borrowers with comprehensive information and disclosures, TILA empowers them to understand the true cost of credit, potential risks, and consumer rights.

Preventing predatory lending

TILA’s requirements help mitigate predatory lending practices, so borrowers are not subjected to abusive terms or unexpected costs they might struggle to afford.

The Act is meant to level the playing field between lenders and consumers, fostering a more transparent and equitable credit market.

What are closing costs?

Closing costs in Utah refer to the fees and expenses incurred while finalizing a real estate transaction. The costs are typically shared between the buyer and the seller and are paid at closing when ownership of the property officially transfers to the buyer.

The expenses vary based on the transaction and parties involved but some common components of closing costs in Utah include:

1. Loan-related costs

These include fees associated with the mortgage loan including (but not limited to):

- loan origination fees

- discount points (optional fees paid to lower the interest rate)

- credit report fees

- appraisal fees

2. Third-party fees

These are charges paid to outside service providers involved in the transaction. They might include:

- title fees and title insurance

- attorney fees

- survey fees

- inspection fees

3. Prepaid expenses

Some items need to be paid for in advance. These include but are not limited to:

- property taxes (the property taxes will be held in escrow until property taxes come due in your state)

- homeowners insurance

- prepaid interest

4. Escrow fees

Utah typically uses an escrow process, where a neutral third party holds funds and documents until the transaction is completed. Escrow fees cover the services provided by the escrow agent. These can include:

- courier fees

- recording fees

- document preparation fees

- notary fees

- any other administrative expenses associated with the closing process (i.e. courier fees, recording fees, etc.)

Closing costs can vary. Following are some factors that affect the bottom line amount of money due at closing:

- purchase price of the property

- type of loan being used (conventional, FHA, VA, etc.

- property location

- Negotiations between the buyer and seller (this is why you need a great real estate agent on your side)

- The involvement of real estate agents or brokers

Don’t ever enter into a Utah real estate transaction without a clear understanding of what will be required of you at closing.

How much are closing costs in Utah?

In March 2024, closing costs for Utah sellers typically range from 7%–9% of the home’s purchase price, while buyers are usually responsible for approximately 3%–6%.

Here’s some context:

With the median home value in Utah at $600,000, if you’re selling a house in Utah, you might expect to pay $42,000 to $54,000 in closing costs. Conversely, if you’re buying a house, your closing costs could fall between $18,000 and $36,000.

How will I know how much to pay at closing?

In Utah, lenders use a Closing Disclosure to report the amount of your closing costs. The Closing Disclosure is a standardized form that provides detailed information about the final costs associated with a mortgage loan. It is designed to help borrowers understand and compare the various fees and expenses associated with their loans.

The Closing Disclosure includes a breakdown of the buyer’s and the seller’s closing costs. The intention is to provide transparency. This document outlines the loan terms, interest rate, monthly payments, and the total amount of money you need to bring to closing.

Your lender will prepare and deliver the Closing Disclosure to you (the borrower) at least three business days before the closing date. Take time to review it carefully. Compare it with the Loan Estimate you receive earlier in the loan process.

How can I lower my closing costs?

There are strategies to lower your closing costs. Your Utah real estate agent and mortgage lender can help you better understand negotiation. Just remember, you need to weigh your options carefully as some discounts at closing can increase your costs during the life of the loan.

Not all lenders are created equal. Shop around for a mortgage lender that can offer you the best options. Closing costs vary among lenders so take the time to look for the most favorable terms.

Start looking for ways to negotiate at the beginning of the process. Some costs like title insurance and appraisal fees can be lowered. Lender’s title insurance guarantees a clean title to your home. It protects you and your lender by guaranteeing no liens or encumbrances on the home you are purchasing. If the previous owner did not pay property tax, there could be a lien against the property. That is not something you want to find out after you have signed on the dotted line. Title insurance is necessary and required by law. Ask service providers about discounts and decreased fees. You can choose some third-party services that offer flexibility.

Negotiate with sellers. Request seller concessions through your real estate agent during negotiations. Sometimes the seller is willing to contribute to the buyer’s closing costs in Utah. This works best in a buyer’s market. It often happens when you are negotiating with a seller who wants a quick closing or if the home you’re purchasing has been on the market for a long time. Sellers usually pay their closing costs.

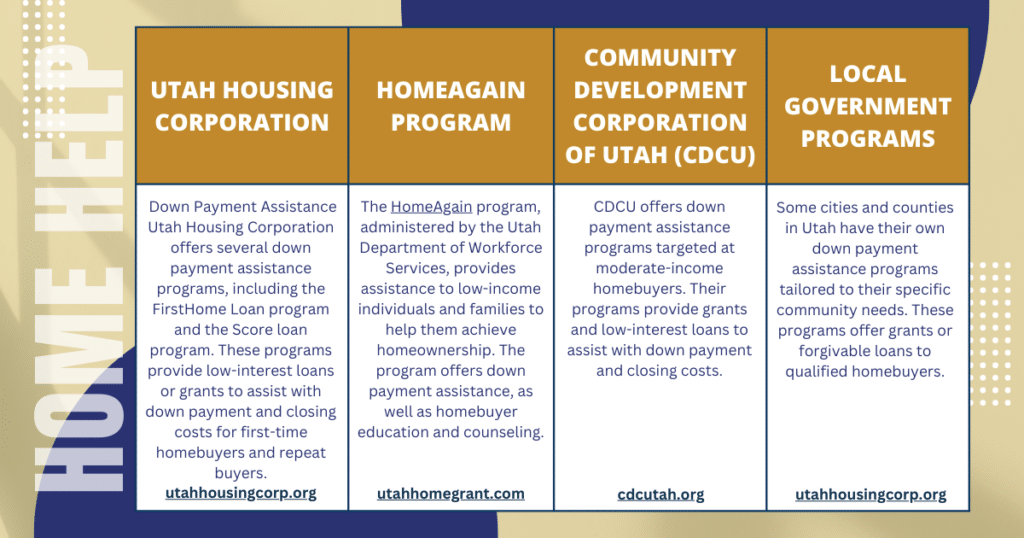

Explore down payment assistance programs

Utah offers various down payment assistance programs that can help buyers with their upfront costs, including closing costs. Research and determine if you qualify for these programs, as they can provide financial relief.

Down payment assistance programs are designed to help individuals and families overcome the hurdle of saving for a down payment. Between a down payment and closing costs, buying a home seems overwhelming.

Assistance programs offer financial help and grants to eligible homebuyers. Specific details and eligibility criteria vary depending on the program. Down payment assistance programs can be valuable to buyers who struggle to attain the American dream.

More ways to save when buying a home

Lender credits

Lender credits work the opposite of mortgage points. With lender credits, you accept a higher interest rate in exchange for the lender covering some of your closing costs. While this reduces your upfront payment, it increases your long-term expenses due to the elevated interest rate.

No closing cost loans

There are “no-closing costs” loans available out there. Some programs will fold the buyer’s closing costs into the loan and finance them. The downside to doing that is that it will cause your monthly payments to increase. It will also increase your loan-to-value ratio. This might seem like a good idea in the short term but weigh your options and seek the advice of a financial consultant if necessary.

Read, review all loan documents

Review the buyer’s and the seller’s closing costs. Question any discrepancies you find. Your real estate agent can help you make sound decisions about your real estate purchase with the power of wisdom and experience.

Do you still have questions about closing costs in Utah? Call me! I am here to help. My team will walk you through every step of the home-buying process.